Embarking on the “No Spend Money Saving Challenge” is like giving your wallet a well-deserved vacation—one month at a time. As moms, we’re the CFOs of our households, so here’s a savvy strategy to bulk up that savings account or rainy-day fund. It’s about choosing what not to spend money on each month and watching those non-spent dollars stack up. 🏦🌱

What is the “No Spend Money Saving Challenge”? 🧐

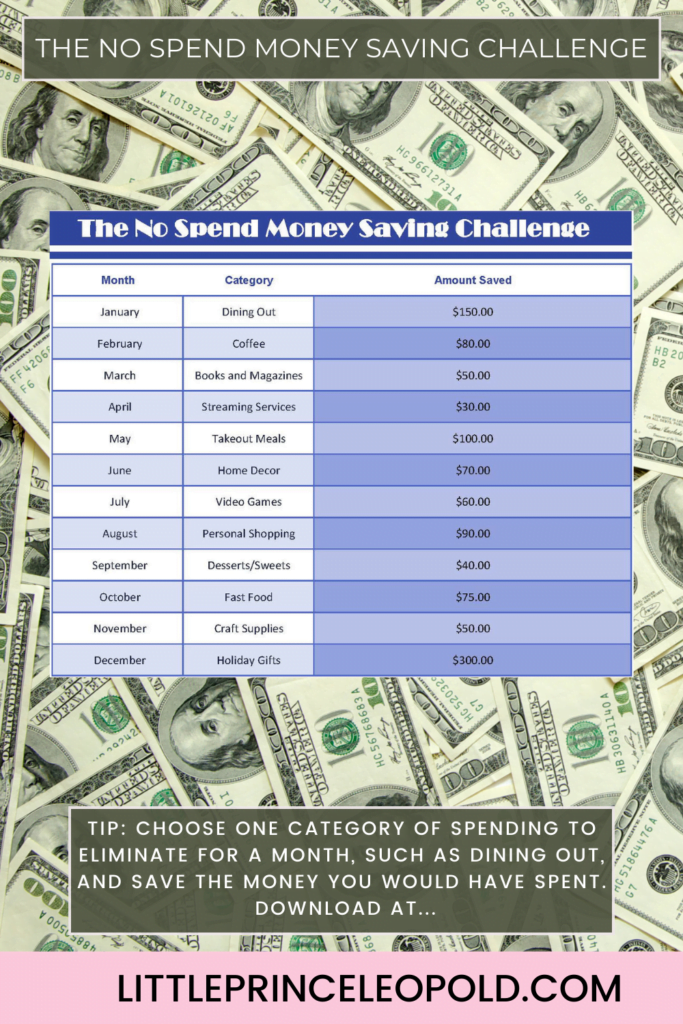

This challenge is beautifully simple: Each month, you select a category of spending to eliminate. Maybe it’s that daily gourmet coffee or those spontaneous online shopping sprees. Instead of spending as usual, you pocket the money.

How to Choose Your No Spend Categories 🤔

- Analyze Your Habits: Look at your bank statements and see where your money goes. What stands out?

- Pick Your Targets: Aim for categories that won’t drastically alter your quality of life but will cut out unnecessary spending.

- Make it Varied: Mix it up! Choose different types of expenses each month to keep the challenge fresh and comprehensive.

Tips to Keep You on Track 🛤️

- Set Clear Goals: What’s your saving for? A vacation, an emergency fund, or maybe a college fund? Having a clear goal can be incredibly motivating.

- Get the Family Involved: Turn it into a game. Who can save the most by skipping their usual spends?

- Reward Yourself: Not from the saved money, of course, but allow yourself some inexpensive or free treats to celebrate hitting your targets.

Example Savings: A Hypothetical Year 📆

January: Skip the movie rentals. Dust off those old DVDs or play charades instead. Savings: $25

February: Cut out fast food. Discover the joy of crafting meals with what’s already in the pantry. Savings: $75

March: Forego buying new clothes. It’s time to rock the pieces you already have in new combos. Savings: $100

April: Drop the car washes. Instead, grab buckets and sponges and make it a fun family affair. Savings: $40

May: Stop the takeout. Challenge yourself to batch-cook or explore new recipes. Savings: $150

June: Say no to new gadgets. Make the most of the tech you have, or find free tech solutions. Savings: $200

July: Eliminate the fancy drinks. Enjoy homemade iced tea or infused waters. Savings: $50

August: Avoid the bookstore. Revisit old favorites or swap books with friends. Savings: $60

September: Skip the salon. Try out new hairstyles at home or go for natural beauty. Savings: $80

October: Ditch the decorative items. Get crafty and repurpose or upcycle things you already own. Savings: $30

November: Cut out the paid apps. There’s likely a free version that works just fine. Savings: $20

December: Reduce holiday extras. Focus on meaningful traditions that don’t cost much. Savings: $150

What You Could Do with Your Savings 🚀

- Start an Investment: Small amounts can grow over time if you invest wisely.

- Plan a Family Trip: Use the saved money for an experience you’ll all remember.

- Boost Your Home: Make those home improvements you’ve been putting off.

Remember, It’s a Personal Challenge 🎯

The “No Spend Money Saving Challenge” isn’t one-size-fits-all. It’s about finding what works for you and your family. It’s not about deprivation; it’s about making smarter choices and enjoying the benefits of saving. After all, every dollar you don’t spend is a dollar you’ve saved—and those dollars can add up to make dreams a reality. So, let’s get saving!